Shadow Facts: Economic Reset - April 2023

Datapoints Highlighting Challenging Economic Times Ahead

To see a Summary of all current Shadow Facts, go to the Shadow Facts Dashboard.

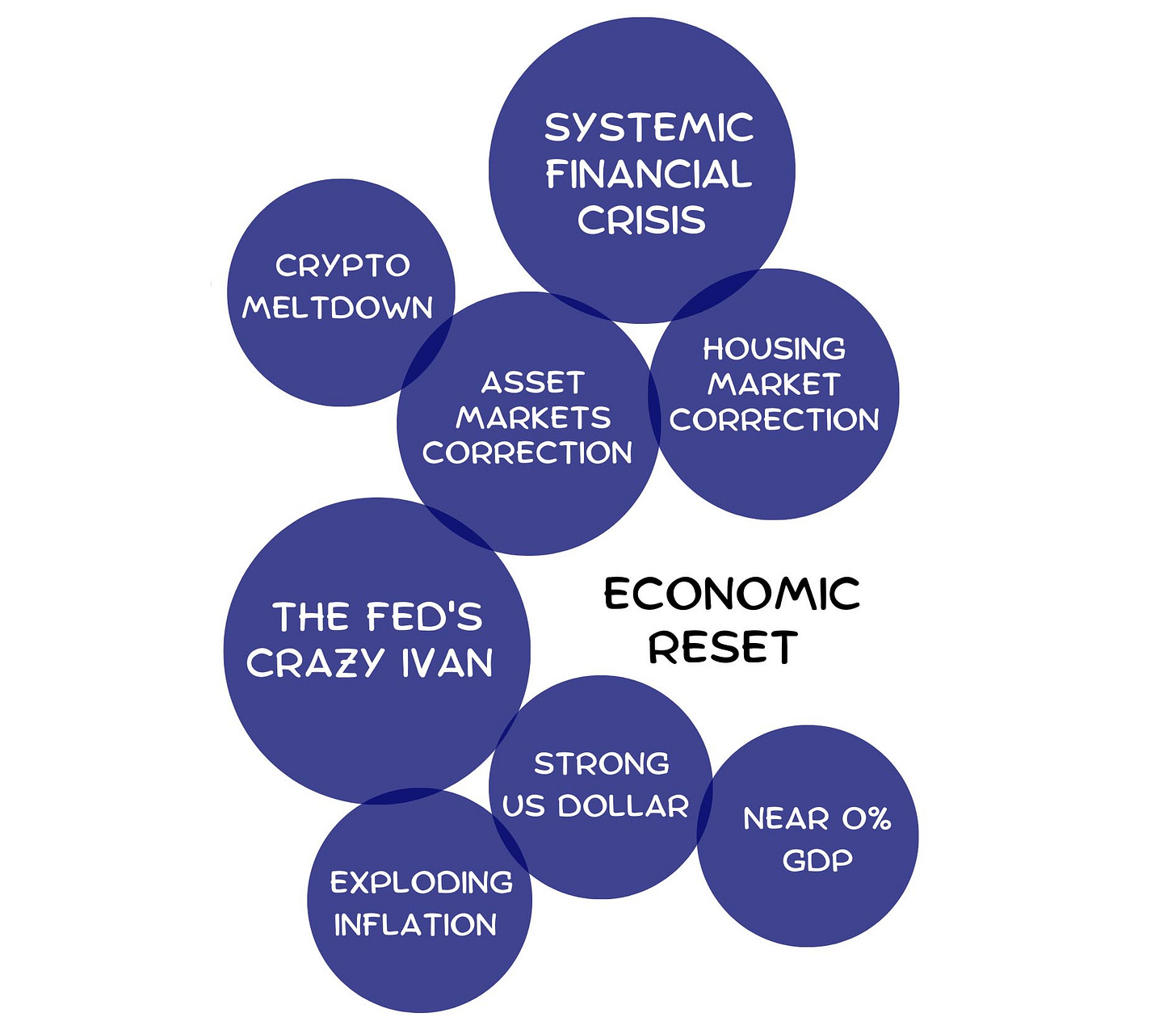

The Federal Reserve has made a 180-degree policy reversal, attempting to Reset the Economy after creating a Tsunami of inflation. First impacts include housing and asset market corrections and now signs of a Systemic Financial Crisis with bank failures necessitating a FED bailout.

1. The FED’s Crazy Ivan

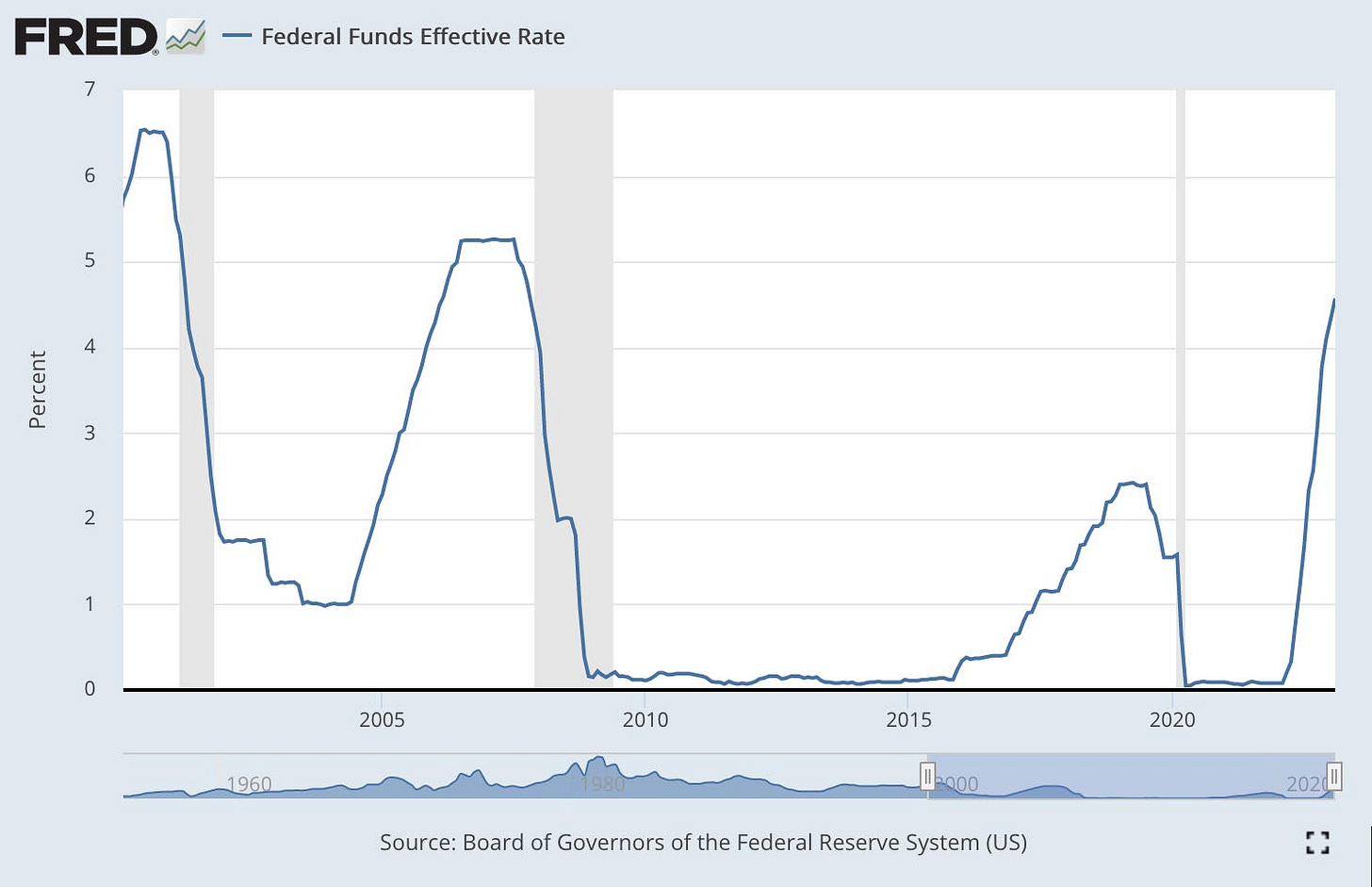

The FED has raised the target Fed Funds Rate to 5.0% from near 0% a year ago with promises of more increases ahead. Previously the FED had lowered interest rates to 0% and was running the printing presses at $120B/month of QE. After inflation exploded and the FED realized it was not transitory, they reversed policy 180-degrees.

Below is a chart of Federal Funds Rates in recent years. Note that the FED pinned the rates at ultra-low levels after the 2008 economic recession and again with the pandemic outbreak. These swings in Funds Rates cause significant moves in asset prices, particularly equities and housing, but now also in AAA Bonds.

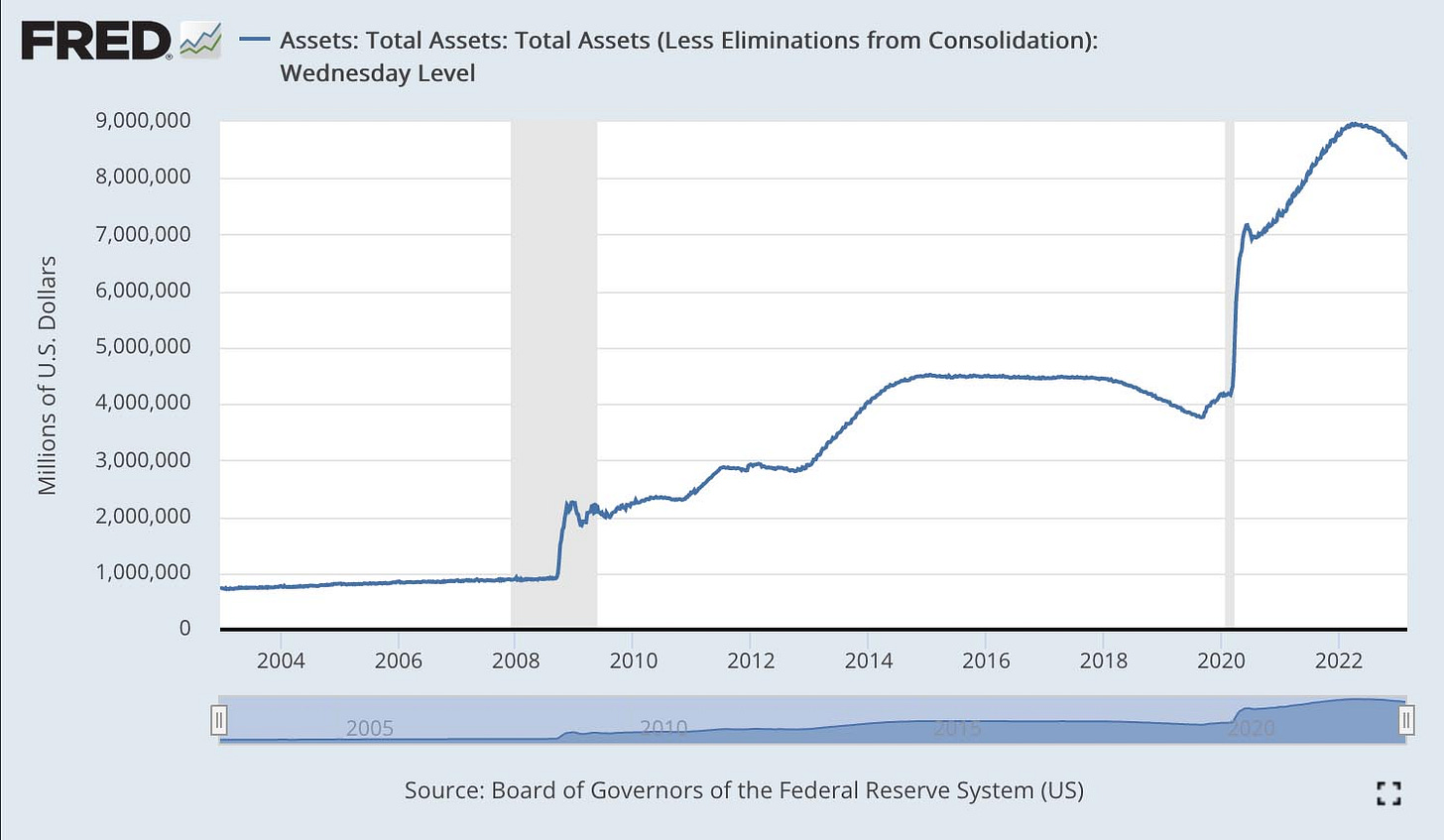

Below is a chart of the FED’s balance sheet. Notice the aggressive increases (essentially printing money) as they raised the levels by $120B/month. They kept this aggressive pace of money printing to support the governments’ excessive stimulus, even after the rollout of the vaccines which were supposed to end the Pandemic. Total money printing reached around $5T to match congressional spending.

These moves by the FED are really an experiment in monetary policy, and the rapid reversal between policy extremes is a “Crazy Ivan.” The fact that the FED could be pushing so hard one way and then reverse to pushing so hard the opposite way suggests that they do not have adequate frameworks and analyses for policy decisions. For markets conditioned on free money, this reset will inevitably break things, and the FED will be challenged to contain the problems resulting from its actions.

End of the Great Experiment

The FED may be trying to end the low interest rate Great Experiment, not just responding to the current inflationary crisis. The FED lowered interest rates to near zero after the 2009 financial crisis and has kept rates abnormally low. This has subsidized a chase for yield resulting in widespread malinvestments and asset bubbles. It is not good for the economy. Just think about a company like Boeing: they cobble together the failed 737-MAX instead of designing a new plane, and they use the money saved combined with new low-interest borrowings to buy back their stock. Just think of how much better off Boeing would be now if they had invested in designing a new platform and skipped the FED subsidized buybacks. If the FED is trying to correct this failed Great Experiment, then the investment logic of the last 14 years will be upended. It is unclear that the FED will be able to navigate these uncharted waters without causing financial instability and being forced to retrench.

The End of an Era

Longer term, one big change coming out of the move to a Multipolar World is intensifying de-Dollarization across the world. Kind Dollar has ruled since the end of WWII, and this Dollar Hegemony is coming to an end, a once in a lifetime event. The long-term bet is that this will end up weakening the Dollar over time which will add to inflationary pressures and create challenges for funding deficits and the total U.S. Debt. Navigating this change will be the ultimate challenge for the FED and U.S. Leadership, establishing a new equilibrium and avoiding a disastrous financial collapse. There is a risk that this challenge may provoke panicked reactions, such as launching new wars against Russia and China. This is the riskiest period of time since WWII and hopefully cooler heads and smarter thinking will prevail.

2. Exploding Inflation

Starting in the beginning of 2021 inflation took off with the excessive stimulus supported by FED monetary printing. Much of this stimulus was implemented through direct deposits into bank accounts, the fabled “Helicopter Drop” of money that bypasses typical economic processes. It seems the FED did not have adequate modeling of the impact of this “Helicopter Drop” money and misunderstood the original upswing in inflation as transitory. In Feb 2021 Larry Summers had warned:

this scale of macroeconomic stimulus might “set off inflationary pressures of a kind we have not seen in a generation, with consequences for the value of the dollar and financial stability.”

And after the explosion of inflation he said: “Excessive stimulus driven by political considerations was a consequential policy error…”

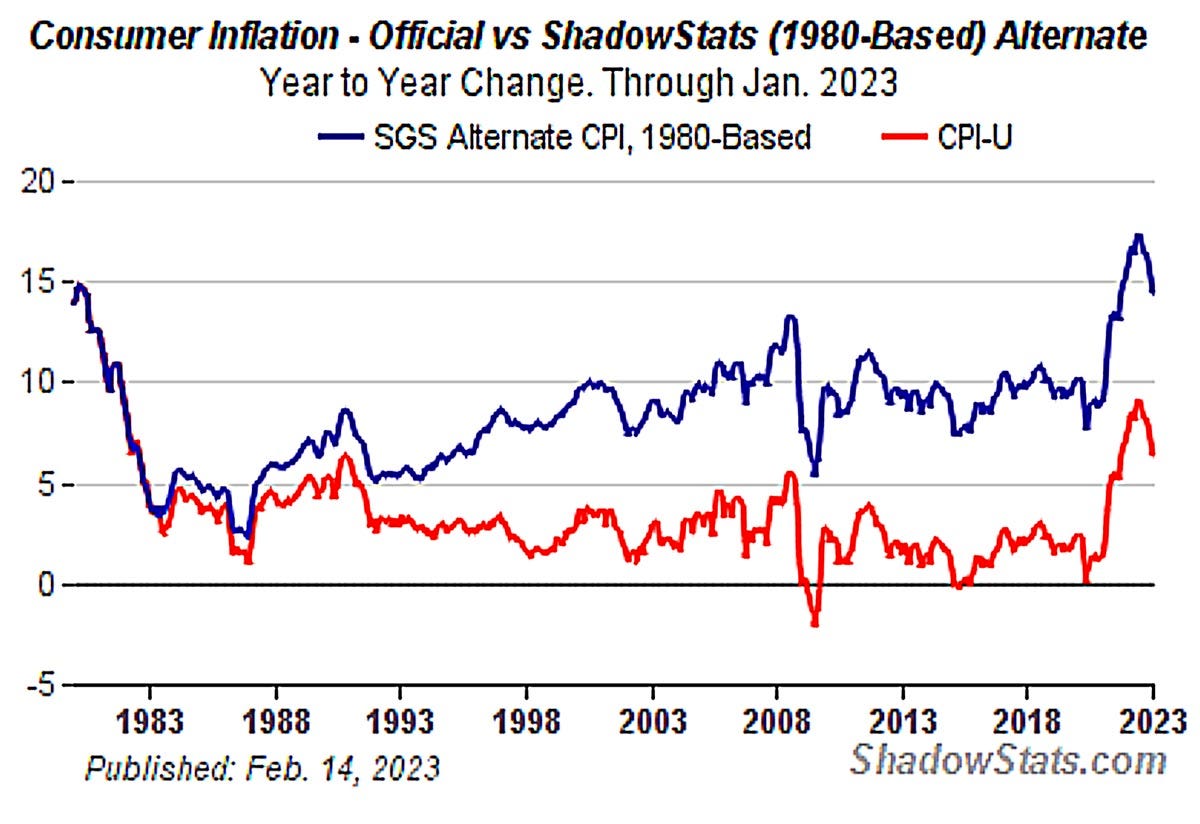

CPI reached a current peak in August 2022 at over 8%. Perhaps a better dataset is produced by ShadowStats, which uses the older government methodology from 1980 to calculate inflation statistics. Below is a chart from Shadow Stats that compares the recent BLS CPI numbers to the CPI calculated on 1980-Based methodology. The ShadowStats CPI numbers peaked at over 16% or double the BLS numbers. Inflation for the typical consumer probably feels more like the ShadowStats numbers compared to the BLS CPI numbers. Note that the revised CPI numbers have been significantly understating inflation compared to the 1980 methodology. Using either methodology these are the highest inflation numbers since the early 1980s or 40 years ago.

3. Housing Market Correction

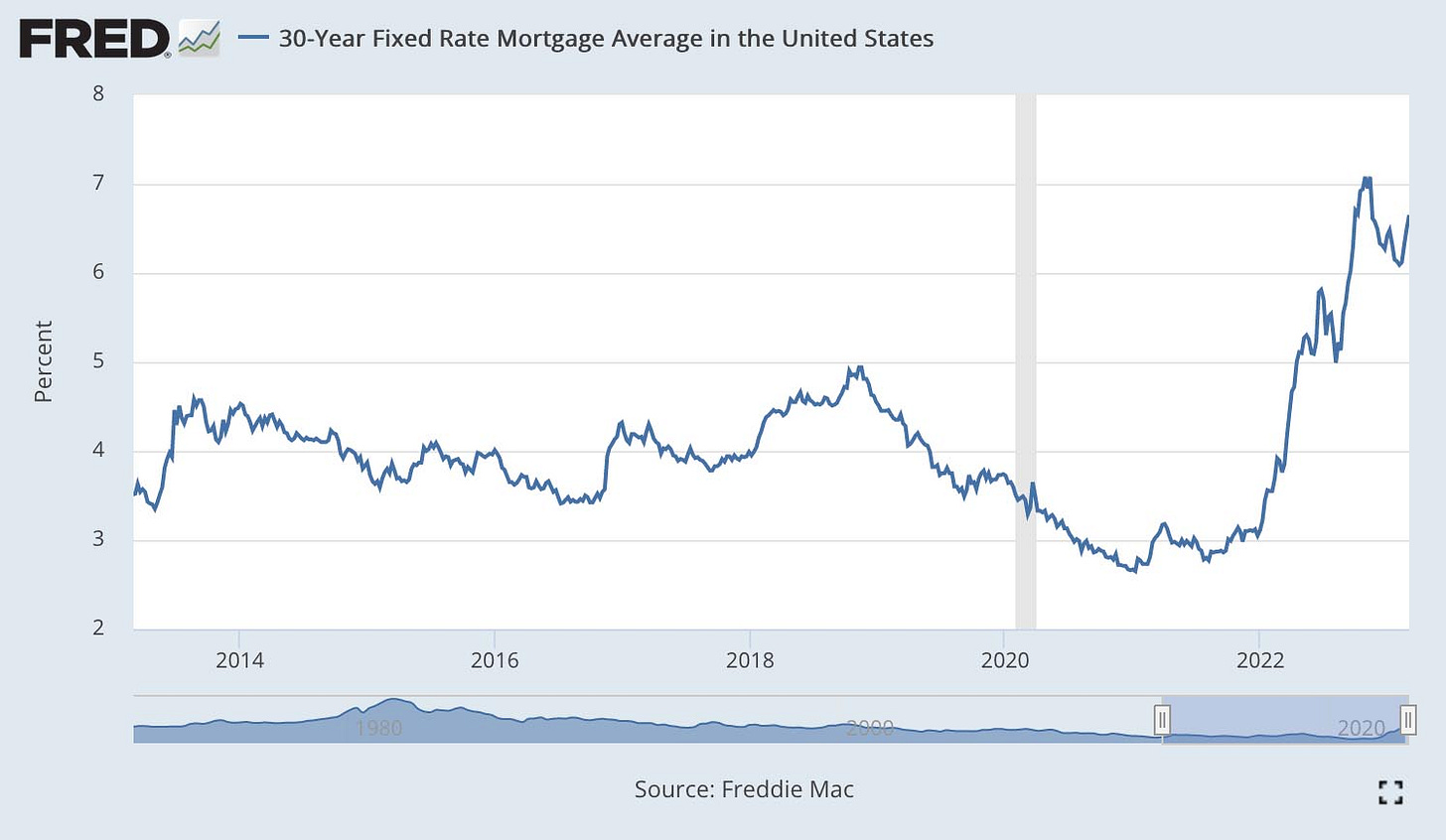

30-year fixed mortgage rates hit a low in August 2021 around 3.0% and then more than doubled in the following year. Current rates as of 04/15/23 are at 6.50%. Comparing a 3.11% and 6.42% mortgage, the change in 2022, a borrower with a 300K loan will pay $1880/month versus $1283/month, or 47% more. The housing market cannot sustain this kind of jump in consumer cost structure. The housing market will rebalance through price declines, inflation/wage increases, and eventually a softening of interest rates. See the rapid rise in rates in the chart below.

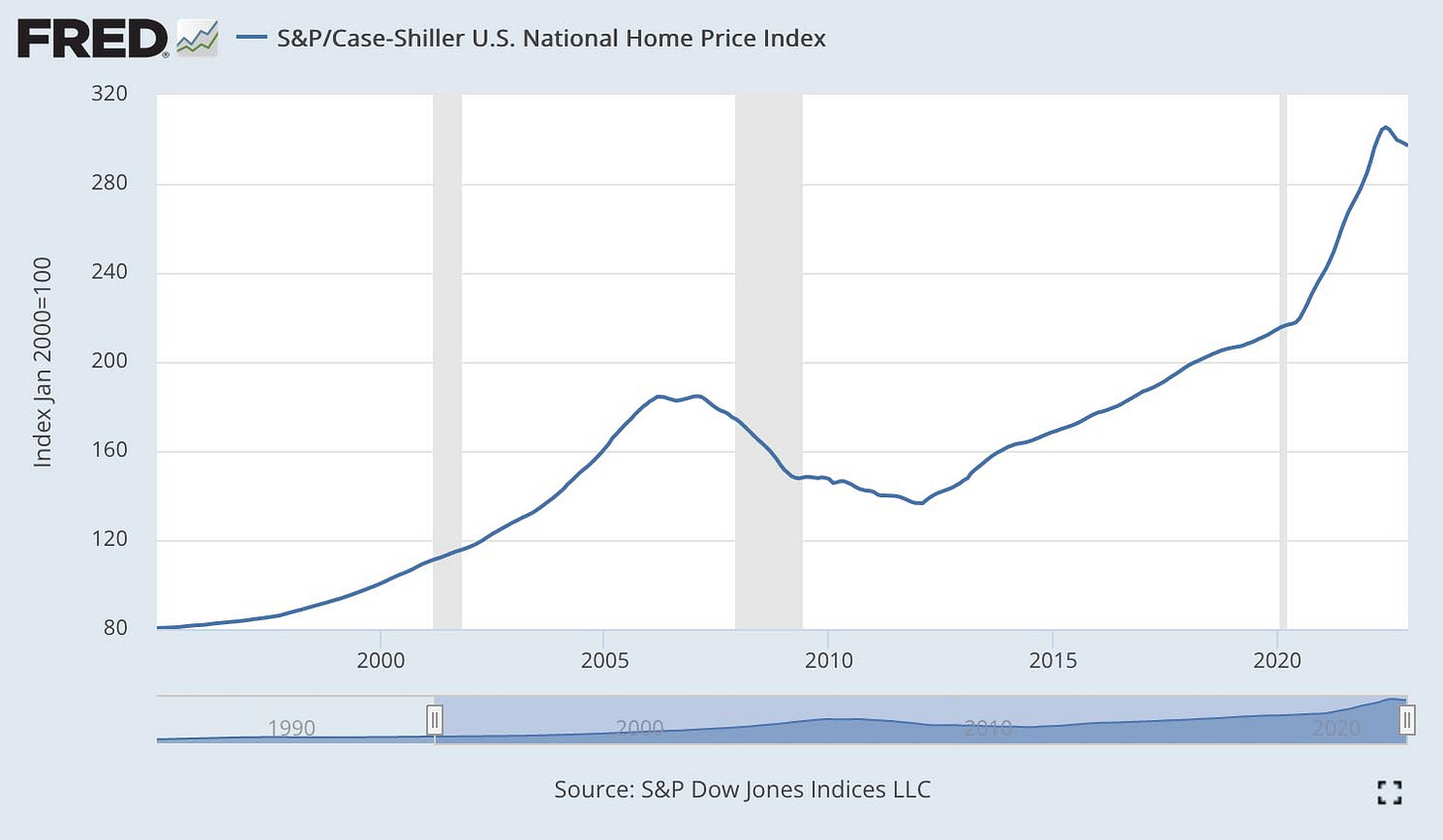

These rates are already impacting housing prices, and the Case Schiller US National Home Price Index peaked in June 2022 and has been coming down since then (see chart below). This index typically lags the housing market by up to 6 months, so the actual market is likely much softer than represented by this decline. Note the huge price increase coincident with the pandemic and ultra-low interest rates. This entire excessive move will rapidly be undone by this correction with a 20% drop likely in the Index. The 2007 Housing Bust took 5 years to bottom with the Index dropping 26%. Expect this to be a quicker drop given the pandemic spike.

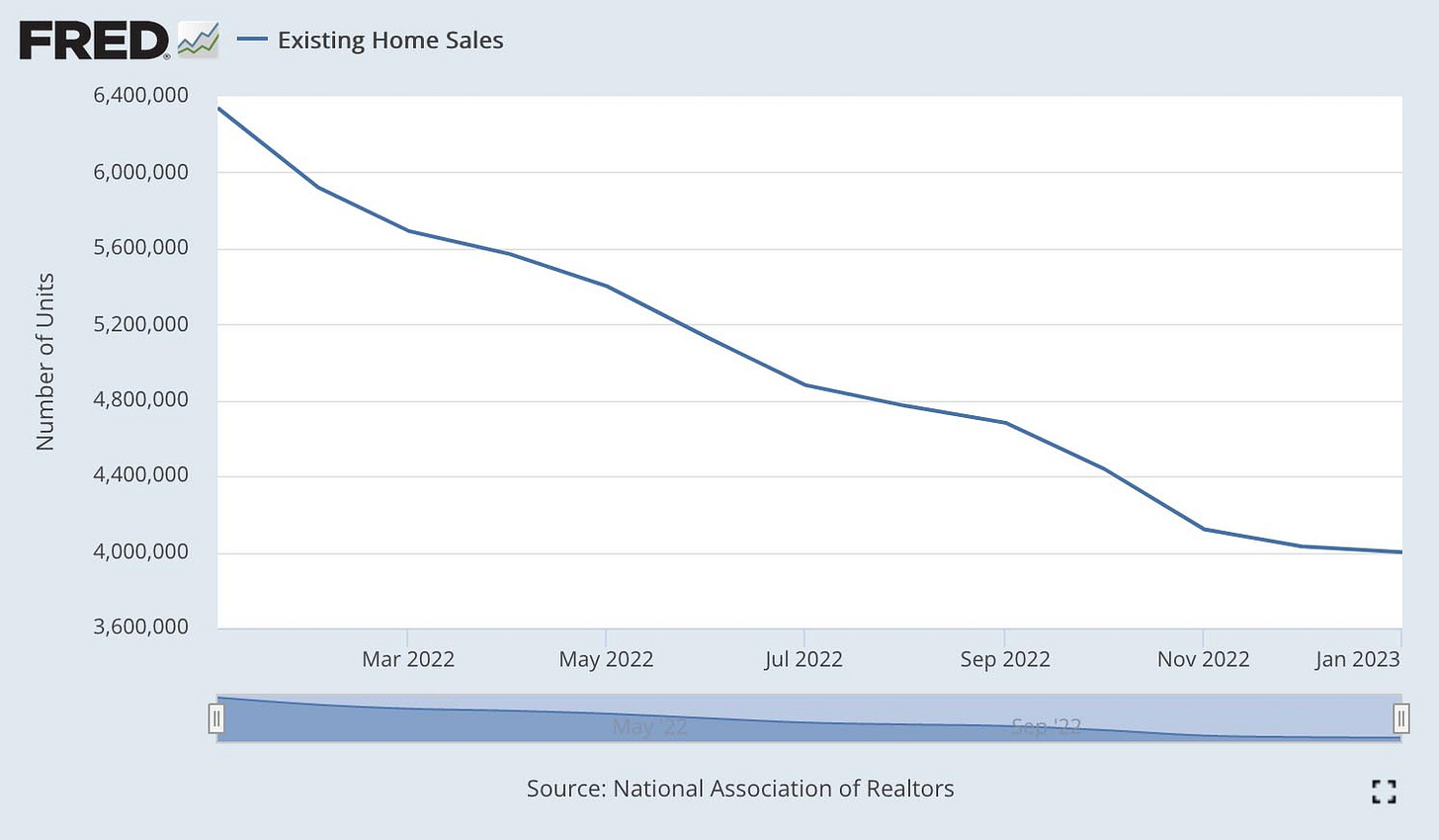

Below is a chart of Existing Home Sales, and sales are down 35% in a year as the housing downturn gains momentum. In a typical housing correction the sales volume drops first, then inventory starts to build, and then prices come down. The only caveat here is that with so many owners having locked in low rates there may be a reluctance to put houses on the market which will restrain inventory build.

4. Asset Markets Correction

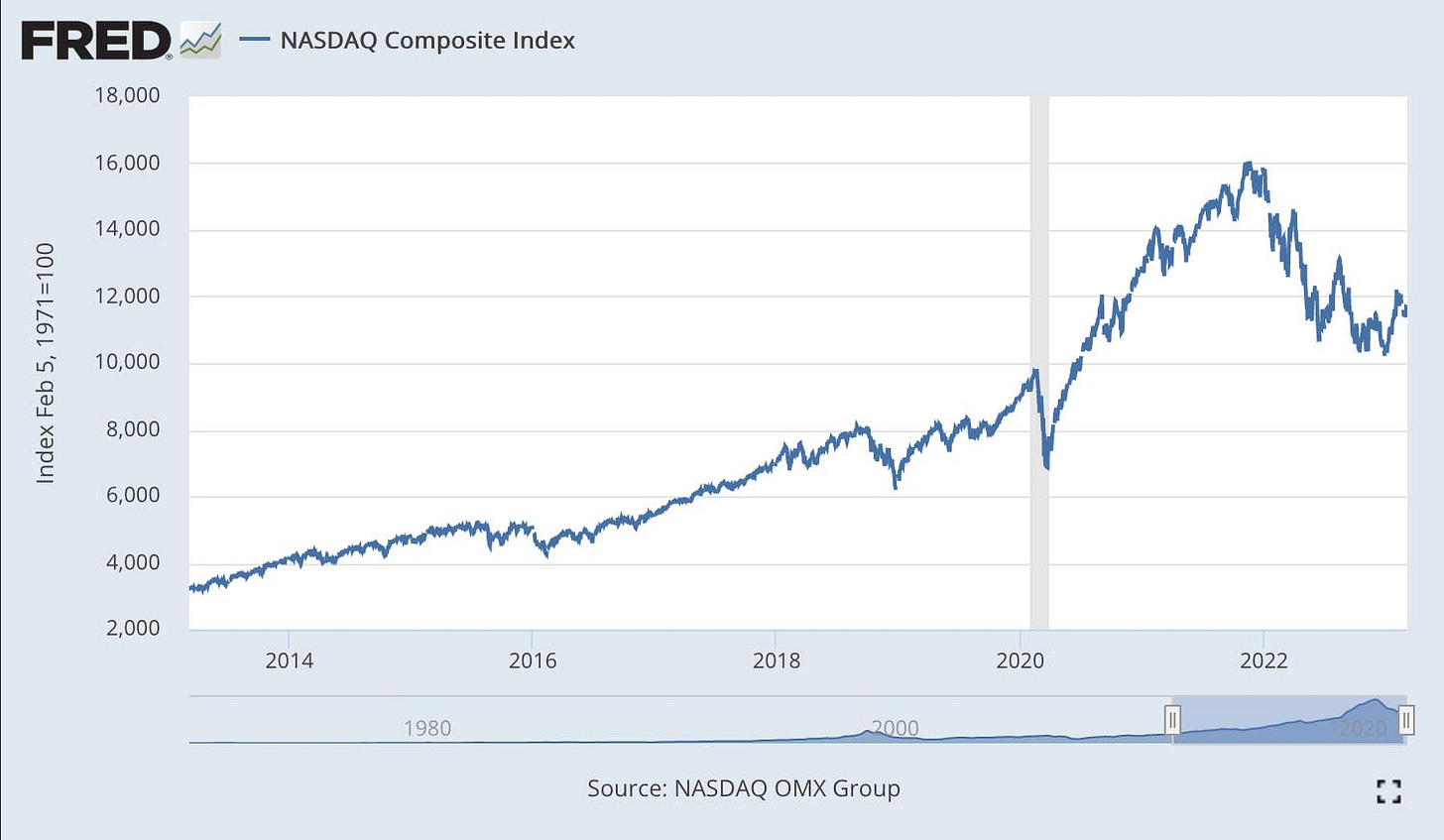

2022 had the worst market performance in years. 2022 results include S&P Aggregate Bonds Index -12%, S&P -19%, Nasdaq -33%, FAANGS -44%, Crypto -65%, and IPO ETF -56%. The NASDAQ chart below shows how the markets took off as the FED ramped up the monetary printing presses. This money went straight into boosting asset prices and creating asset bubbles, and now the FED is slaying this artificial valuation. The markets had a strong Q1 in 2023, but the recent rise in the markets looks like a minor bear market rally on this chart.

The history of bubbles suggests these extremes of NASDAQ 16,000 will not soon be regained. After the 2000 Bubble popped the NASDAQ did not regain its old highs for 15 years, and many of the leaders in the bubble were wiped out. Expect more downside as valuations correct to more typical levels, particularly in the speculative assets, and do not expect them to return to bubble highs anytime soon. Traders often look at Fibonacci retracements as targets, and from the previous lows in 2009 these NASDAQ targets would be 10400 (hit already), 8660, and 6920.

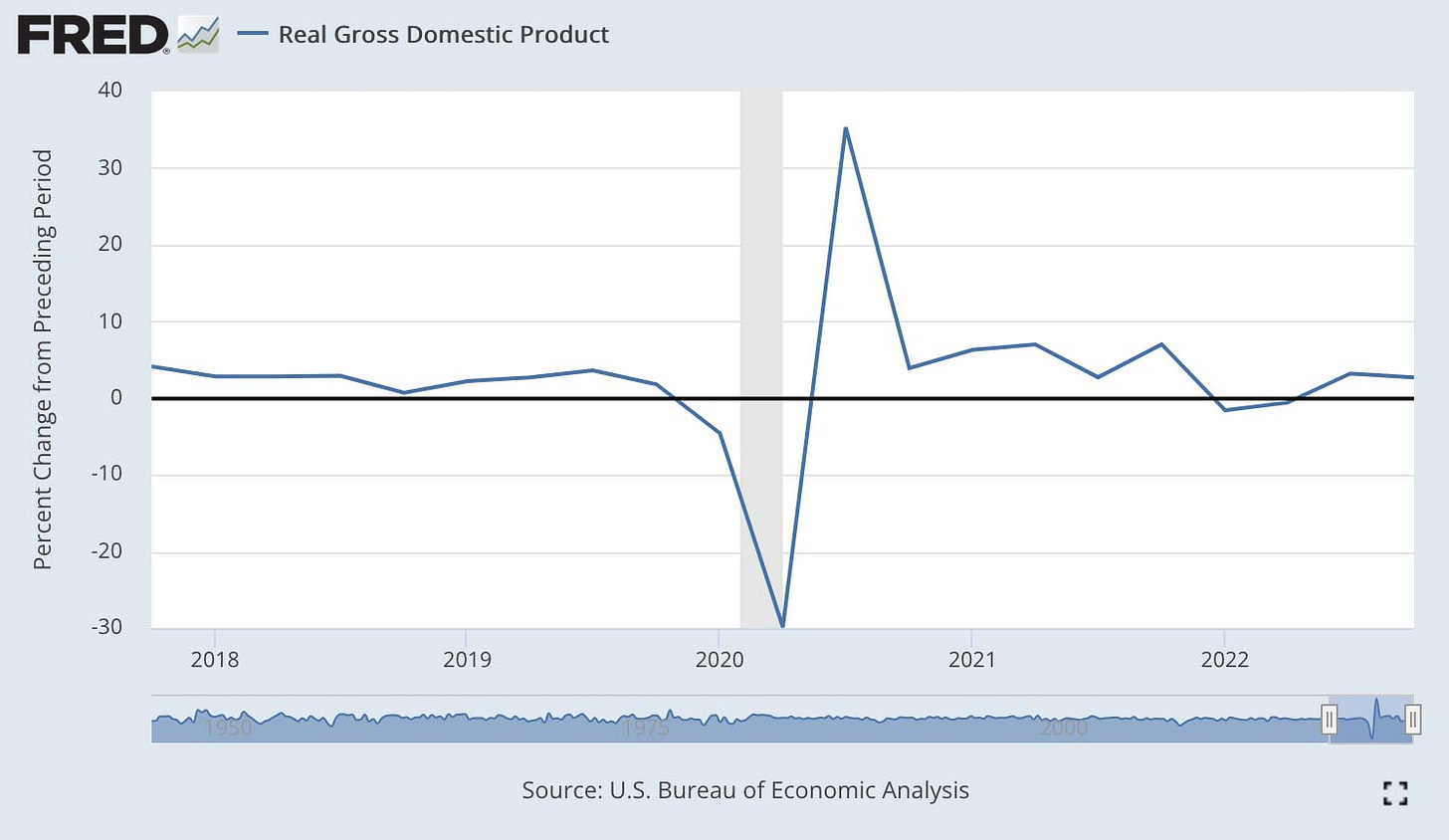

5. Recessionary GDP Numbers

2022 GDP numbers dipped to recessionary levels and recently bounced back. 2022 Real GDP numbers were Q1 -1.6%, Q2 -0.6%, and Q3 +3.2% and Q4 +2.6%. If CPI numbers are understating real inflation as Shadow Stats suggests then GDP is being overstated and may be weaker than reported. Current GDP Now estimates are 2.5%, stable with the trend of Q3/Q4. These numbers are stronger than expected following the recessionary numbers of last year, but the expectation here is that the FED will move too far to slay inflation, baking in a recession for 2023.

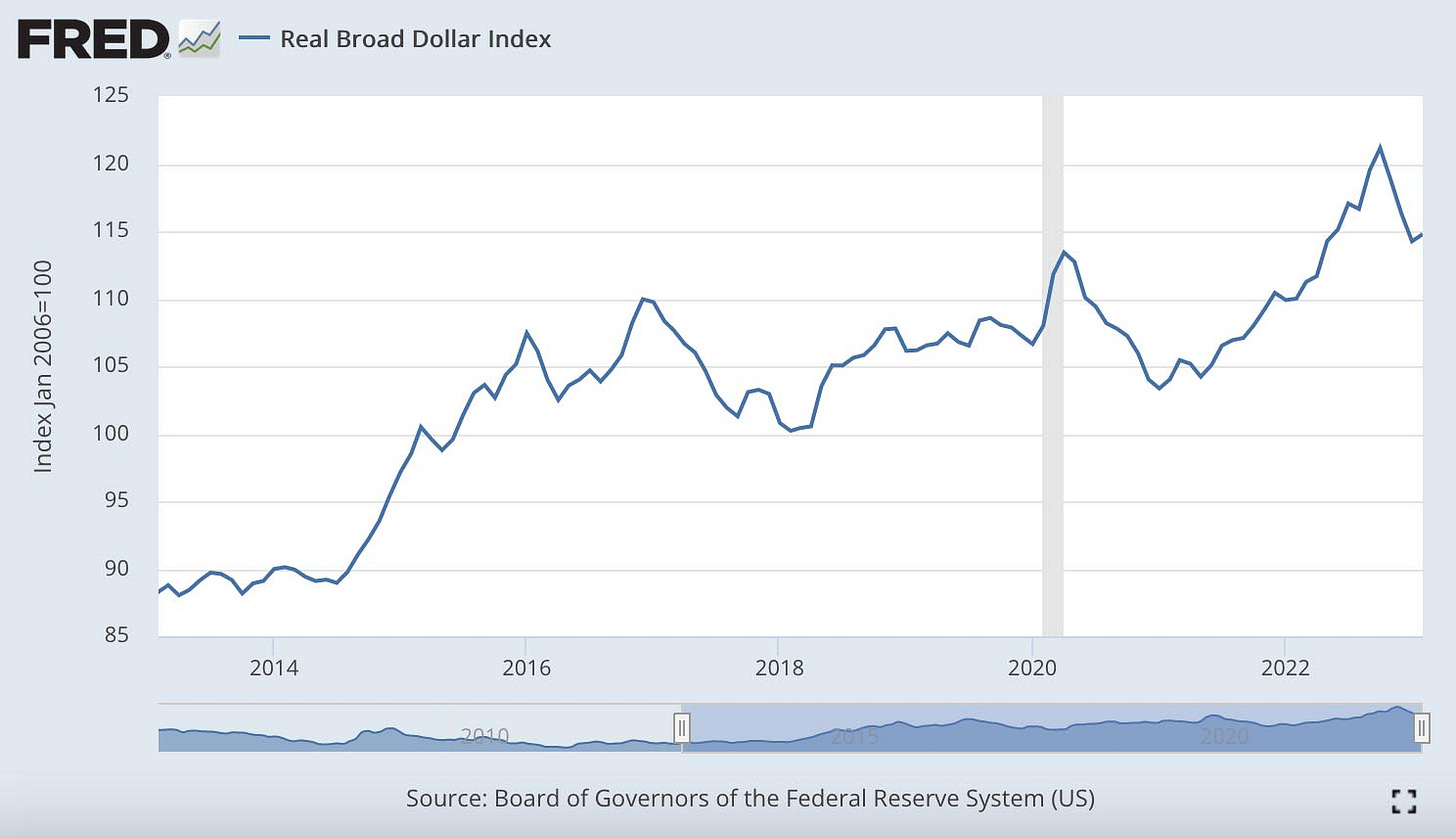

6. Strong Dollar

The Dollar was up 7.8% in 2022 and 15.1% over 2021 and 2022 (see the chart below), but recently the dollar has eased off its strong run. There are large Dollar borrowings internationally and the strong Dollar raises the costs to cover these loans. These foreign countries and foreign businesses that have borrowed using Dollar loans are being squeezed by the rise in the Dollar which increases the amount of local currency they need to make repayments. This rise in costs is putting additional pressure on other countries’ budgets that are already burdened with rising food and fuel costs. The Federal Reserve raising interest rates is directly responsible for the strengthening Dollar which then threatens the entire global economy.

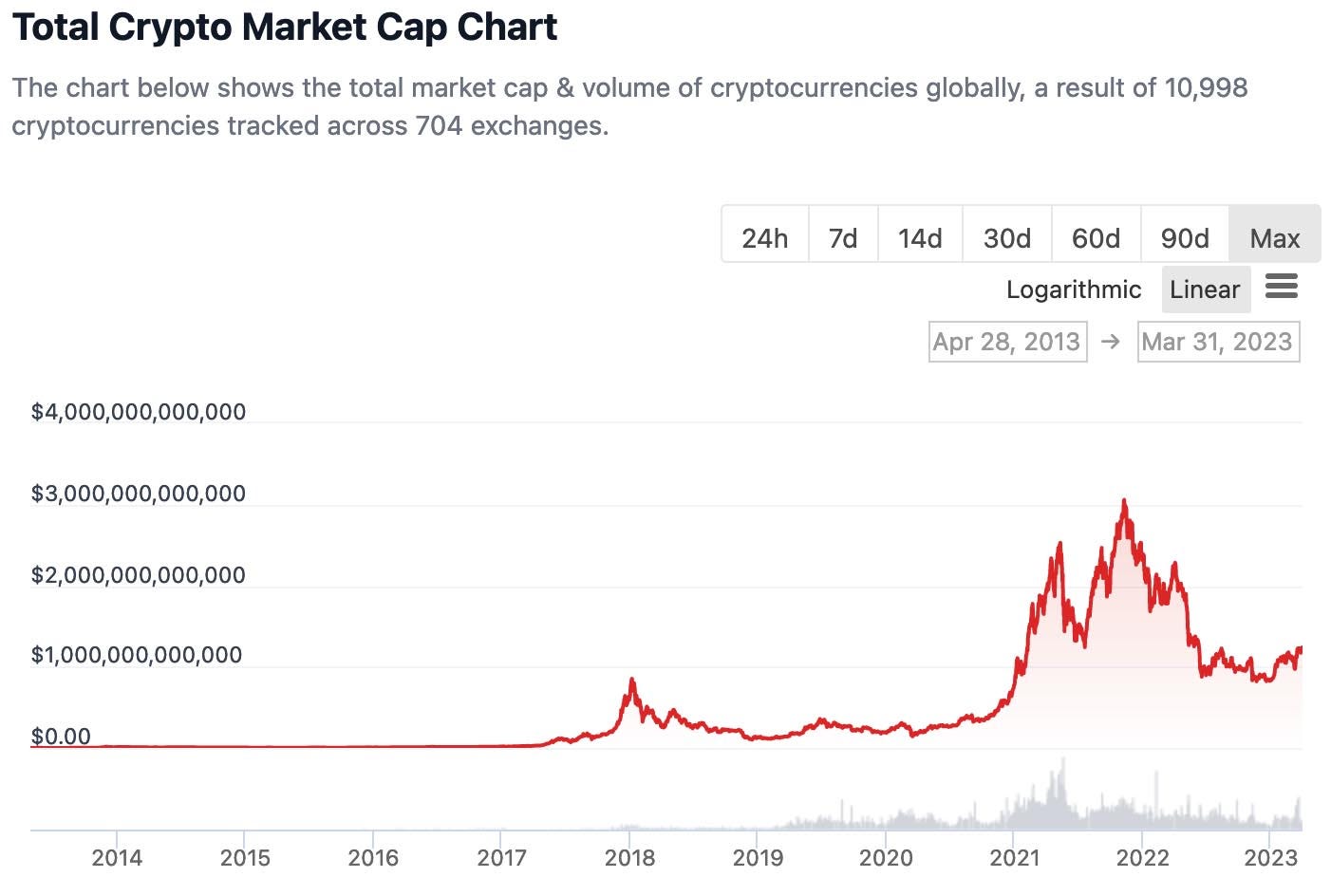

7. Crypto Meltdown

Last year the trading platform FTX and its trading arm Alameda Capital blew up in an extraordinary dumpster fire of malfeasance and incompetence. This may turn out to be a harbinger for the whole Crypto Industry, which seems to be a Ponzi scheme with trading in various dubious PonziCoin. If the blowups stay within the Crypto space, the damage may be contained, but if there are enough linkages to real world financial entities, the Crypto Meltdown could potentially lead to another systemic financial crisis. The chart below from CoinGecko.com shows the Crypto Market Cap drop to $1240 Billion, down 60% from its peak in November 2021.

This chart represents 10,998 cryptocurrencies across 704 exchanges! This is funny and crazy and shows you just how nuts the world has become. There is a whole world out there creating and trading PonziCoin with each other. Cryptocurrencies have been described as a way for “Very Very Smart People” to take money from “Very Smart People.” Crypto is all very clever and it looks like a stunning collection of interconnected Ponzi schemes that will eventually end as all Ponzi schemes do.

8. Systemic Financial Crisis

Silicon Valley Bank

Silicon Valley Bank with $209B in assets, a key bank at the heart of Venture Capital and Startups, experienced a Digital Bank Run and was closed down by regulators. Problems originated from the freezing up of the venture capital world, with new deals way down and IPOs stopped; this caused new deposits to slow while existing funded startups were making withdrawals for operations. SVB had invested their deposits mostly in “safe” AAA treasuries and mortgage bonds, but the FED’s moves on interest rates caused these investments to lose value. When SVB needed to sell securities to cover short term obligations, they took a big hit, losing $1.8B. This spooked the depositors, who realized the next tranche of investments, those marked HTM or Held to Maturity, were worth much less than book value and if they needed to be sold the bank would become insolvent. The HTM bucket was created after the last crisis, and banks can hold investments here marked to book value instead of current market value. To show how this took out SVB, as of Sept 30, 2022, the $93.3B HTM portfolio was only worth $77.4B if marketed to market, representing a loss of $15.9B, compared to its equity of $11.5B. Fears spread and tech savvy depositors took out their phones and withdrew $40B in 24 hours. A Digital Bank Run. Signature Bank with $118B in assets was targeted next and failed on the same day.

Systemic Financial Crisis

This is a Systemic Financial Crisis. The bank failed because its safe AAA securities lost too much value due to the FED’s aggressive interest rate moves. Other regional banks came under the gun for fears of similar risks in their HTM portfolios. This developing crisis caused the FED to step in with a bailout to stem the fears and reign in the contagion. Note that no bank can sustain a bank run since most of their deposits are invested in longer dated securities. And no bank can change their long-term investments overnight to accommodate the rapid interest rate rises of the FED. FED policies have created a systemic problem by undermining the value of AAA securities that underpin the banking sector. The banking system is estimated to have up to $2T in unrealized losses, and there is ongoing discussion about the potential need to safeguard all $18T in U.S. deposits.

This fear and contagion spread to Europe and Credit Suisse was the next victim. UBS was forced to acquire the troubled bank for $3B in a deal that wiped out $17B in Tier 1 Bonds. As a part of the deal the Swiss National Bank agreed to shore up its financial position by providing $108B in loans to the combined entity.

This may be only the opening act as these big moves by the FED are stressing the financial system. Industry analysts estimate there may be up to 200 banks facing a similar risk as SVB and requiring a larger FED bank bailout. The FED will step in and provide this bailout if necessary.

Credit Contraction and Recession

Some depositors have moved their money from these smaller banks to larger banks in order to safeguard deposits. Since smaller banks are responsible for a large percentage of commercial loans, stresses on these banks will have the knock-on effect of reducing key lending. They will be forced to reign in their lending now that weaknesses in their balance sheets have been exposed and some deposits have been withdrawn. Expect tightening credit for borrowers, pushing a deflationary credit contraction through the system and possibly precipitating the recession.

Discussion of the Economic Reset

The Federal Reserve is creating financial pressures throughout the system after pulling a 180-degree policy reversal. The FED created massive asset bubbles across all asset classes with ultra-low interest rates and $5T in money printing in support of Congressional stimulus. Inflation exploded in assets and then finally in real goods.

Now the FED needs to kill inflation at all costs, including sacrificing the equity and real estate bubbles it created. As Chairman Powell stated in his March 7 congressional testimony, “The historical record cautions strongly against prematurely loosening policy. We will stay the course until the job is done.” But just days later SVB collapses forcing a banking rescue, and now the FED may have to choose between backstopping the banking system or controlling inflation.

Expect a housing downturn with price drops that reverse the excessive pandemic increases. Also expect continued drops in speculative asset prices as the systemic excesses and froth are wrung out of the system. Also expect further challenges from the loss in banking capital caused by the loss in value in AAA securities; lending will likely tighten dramatically tamping down economic activity.

The base case is that these pressures will likely lead the economy into a recession in 2023, but who knows how bad an outlier case could be. The Crypto Meltdown was the first canary in the coal mine for the immolation of all kinds of speculative excesses caused by the FED’s easy money policies. Now the Silicon Valley Bank failure and Credit Suisse buyout reveal a Systemic Financial Crisis, requiring central banks to step in with a bailout to reign in the fear and contagion. FED policy has already started to break things, so keep an eye out for more unintended consequences. In the worst case this builds to a housing correction like 2009 and an equity market correction like 2001 with an ongoing Systemic Financial Crisis.